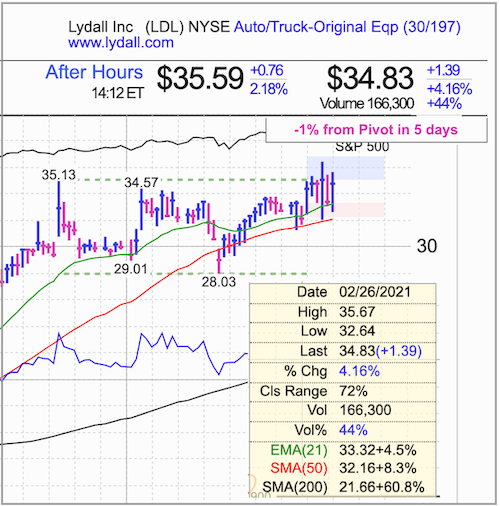

The Darvas box theory is based on the work of Nicolas Darvas, author of the book How I Made $2 Million in the Stock Market. This indicator uses his box theory to help visualize upward trends and find potential opportunities to buy or add to a position.

Darvas was a growth stock trader. After extensive study of historical stock movements, Darvas noted stocks “have a defined upward or downward trend which, once established, tended to continue. Within this trend stocks moved in a series of frames, or what I began to call boxes.“

Continue readingTradingView is my preferred tool for charting and technical analysis.

Check out the free trial!Install the latest release of Darvas Box Theory - Tracking Uptrends indicator.